Forex Trading Tip #1: Wait For The Close

Table of Contents

Impulse Control

One of the biggest operational hazards for traders, especially new traders, is impulsive decisions. If you are a human trader and not an algo, which I assume you are if you’re reading this, then you can surely relate to this challenge.

The market is a constant stream of information and there are no obstacles to your decisions to act on it.

This can be a great thing, but if you do not have effective personal rules that govern your behavior, then it is very likely that you will suffer from a lack of discipline which will lead to inferior results – or a total inability to make profits at all.

An obvious example of an impulsive decision is seeing a huge green candle and immediately clicking the buy button before you even work out where price is, what your stop loss ought to be and where your profit potential might be. You just buy, because the market is going up, and you need to be in it to win it.

Then, of course, because trading is not so easy as buying something that is obviously going up – price reverses on you and before you know it, your excitement turns to dread as you realize you must bail on the position for a much larger loss than you anticipated taking.

A more subtle example is that you are sitting in a profitable trade, and price gets within a few pips of your take profit limit order and then begins to move against you rapidly.

A huge momentum candle begins to form, eating away at your open profits, and you react by exiting your trade immediately – taking a fraction of the profit you were initially targeting.

Then, price action stabilizes, and after a few candles’ worth of consolidation, continues in its original direction and blows right through your initial profit target. You placed a good trade, you were correct in your analysis, you made money – and yet you screwed it up, and probably feel terrible.

This is one of the incredibly frustrating (and counter-intuitive) aspects of trading psychology – sometimes even winning can make you feel bad.

Human Instincts

I personally can recall many embarrassing instances where I got sucked into buying the top of a huge bullish candle out of fear of missing out, often with an extra-large position, only to watch in horror as price immediately retraced and closed as a reversal candle.

Or perhaps the most frustrating scenario of all – I would be in a perfectly valid trade that meets my rules, with my stop loss in place and my position size responsible and appropriate for the setup.

But then I’d make the mistake of watching price action obsessively, sometimes on a much lower timeframe, and I’d notice a big momentum candle forming in the direction of my stop loss.

I’d convince myself that the trade was going to lose and I’d be better off taking a small loss early than the full loss later.

And then, of course, price would come within a few pips of my stop loss and then immediately reverse and rocket on to hit my profit targets, leaving me behind – not only without profits, despite being correct in my analysis – but with a loss.

These are common situations that new traders find themselves in, and some of the main reasons why so many traders fail to find success in the markets.

Trading has the effect of triggering the human brain’s subconscious reaction mechanisms in a way which can cause us to sabotage our own trading results.

I am talking about the fear of missing out, greed, anxiety when confronted with ambiguous market information, and emotional distress as a result of loss (or even gains, which can trigger a fear of losing what you’ve made).

These are all very natural human instincts that have served us well in the past. It is wise to remember that we are not so far removed from our evolutionary ancestors.

We have not outgrown our natural wiring as hunter-gatherers and self-conscious mortal beings. The fact that we all have a chronic fear of loss and pain is not surprising.

Thousands and even just a few hundred years ago, these instincts were extremely important to our day-to-day survival. But as traders, sitting at our desks, looking at computer screens – these impulses have the capacity to ruin us.

~

The subject of subconscious human psychology in relation to trading is a dense one, and a topic for another time. But it is important to understand these ancient cognitive habits so that we can understand what drives us to make impulsive decisions in the first place.

Impulse control is not the same as patience. Sometimes impulsive actions are not necessarily the result of poor self-discipline, but poor self-awareness.

Most of the mental habits you will need to develop in order to become successful at trading will not come naturally. They will need to be learned, grown and built over time.

There is no shortcut, and nothing I write can enlighten you to spontaneously develop them. I have been studying human psychology and self-awareness for over a decade, and I myself still struggle with certain aspects on a regular basis.

But there is one extremely powerful thing I can suggest that will significantly improve your ability to control yourself when confronted with a temptation to make an impulsive trading decision.

Wait for the candle to close.

Wait For the Close

It sounds simple, and to many of you it may even be disappointingly obvious. But this is an important concept for new traders to grasp, and experienced traders to remember.

Just as in life, the markets are almost entirely unpredictable, albeit deceivingly orderly. Usually, it behaves in a way that makes sense even if it often seems random. But the truth is, as any experienced trader will know – anything can happen at any time.

As traders, uncertainty is a monster we must battle constantly. That is our job. To confront uncertainty with skill and confidence and come out the other side winners. If you have read my other articles about Edge and Technical Analysis, then you know my thoughts about this.

So what is one simple habit we can develop as traders to avoid making bad reactionary decisions in the heat of the moment, when anything can happen at any time?

Be calm, patient, professional and wait for the candle to close.

Before you enter a trade, you should have determined a timeframe on which to monitor it. It is rarely wise to consult more than one or two timeframes for trading decisions, so for most traders, deciding which timeframe to base your decision on should be easy.

Once you pick a timeframe to focus on, then stick to it. Don’t place a trade on the 15-Minute chart and then monitor it on the 5-Minute, or even worse, 1-Minute chart. Likewise, don’t place a trade on the 4-Hour chart and then monitor it on the 15-Minute chart.

Of course, there are exceptions to this guideline, but they should be thought of well before a trade is placed and included in your trading plan. Some traders like to place a trade on the 4-Hour chart and then trail their stop loss on the 1-Hour chart. This is perfectly reasonable to do and can be quite effective.

But the rule still applies. If you are a systematic rules-based trader who uses systematic stop losses, then you must always wait for the candle to close before acting on any trading decision you make.

There is a very good reason for this, as I outlined at the beginning – a giant wick was a candle body before the candle closed. Never forget that.

Case Study

It’s easy to identify a rejection candle pattern after the fact, but what is it that makes it a rejection candle in the first place?

Price gets rejected because people who act on those big candle bodies before they close get trapped when the candle closes against them, and are then forced to exit their position for a loss – if they have any sense. But many traders won’t. They wait until things get much worse.

After a clear price rejection, the larger professional traders who had the patience to wait for the candle to close (and have more influence on market direction) are now safe to enter en masse in the direction of the rejection, further fueling price against those traders who are trapped.

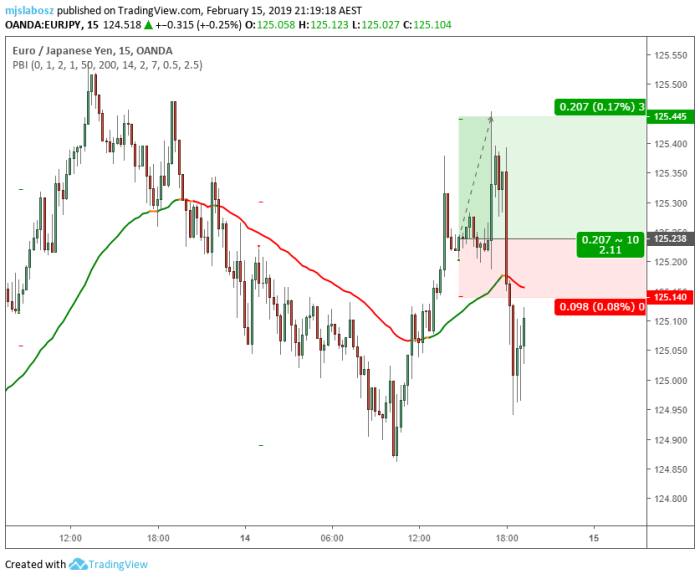

Here is an example that I witnessed recently:

Even I thought this move looked impressive at the time given there was no obvious catalyst. But sure enough, five minutes later, the candle closed like this:

And then price rolled over, and it never looked back:

Those traders who bought the top were soon forced to panic-sell their Long positions right into the hands of more disciplined traders who were waiting patiently to buy back in at a much better price.

This panic-selling caused new traders to pile in on the short side, trapping them next, and causing a rally. Price did not rally significantly from there, as price was in a down-trend. But you can see the recurring pattern:

Conclusion

I happened to be involved in a trade during this bull trap, but I was Long. My take profit limit order (which was an order to sell) was filled at the very high of the wick.

I even got filled at a slightly better price than my actual limit order due to slippage.

This means that I sold my position right into the excited hands of exuberant buyers, rookie traders (like myself a few years ago), who bought the very top of that candle at market without waiting for it to close.

Pure luck, of course. I had no idea this would happen. But I didn’t need to.

They lost, and I won, because I had a plan and I had the patience to see it through. I had the discipline to let my trade play out without emotional interference. I put in the work.

The moral of the story is: always wait for the candle to close before you make a trading decision.